FOSTERING INNOVATIVE, IMPACTFUL & INSPIRED INVESTMENT OPPORTUNITIES

"So then neither is he that planteth any thing, neither he that watereth; but God that giveth the increase"

I Corinthians 3:7

About Us

521 Capital is a synergistic public and private faith driven investment firm which focuses on enterprises creating innovative, inspired and impactful global businesses via scalable technology and inventive solutions. 521 Capital creates these unique investment synergies by combining a fundamentally based and tactically driven diversified long/short public equities portfolio with concentrated private investments in promising I³ early-stage ventures that exhibit an exceptional vision and pathway to producing extraordinary and sustainable financial and social returns.

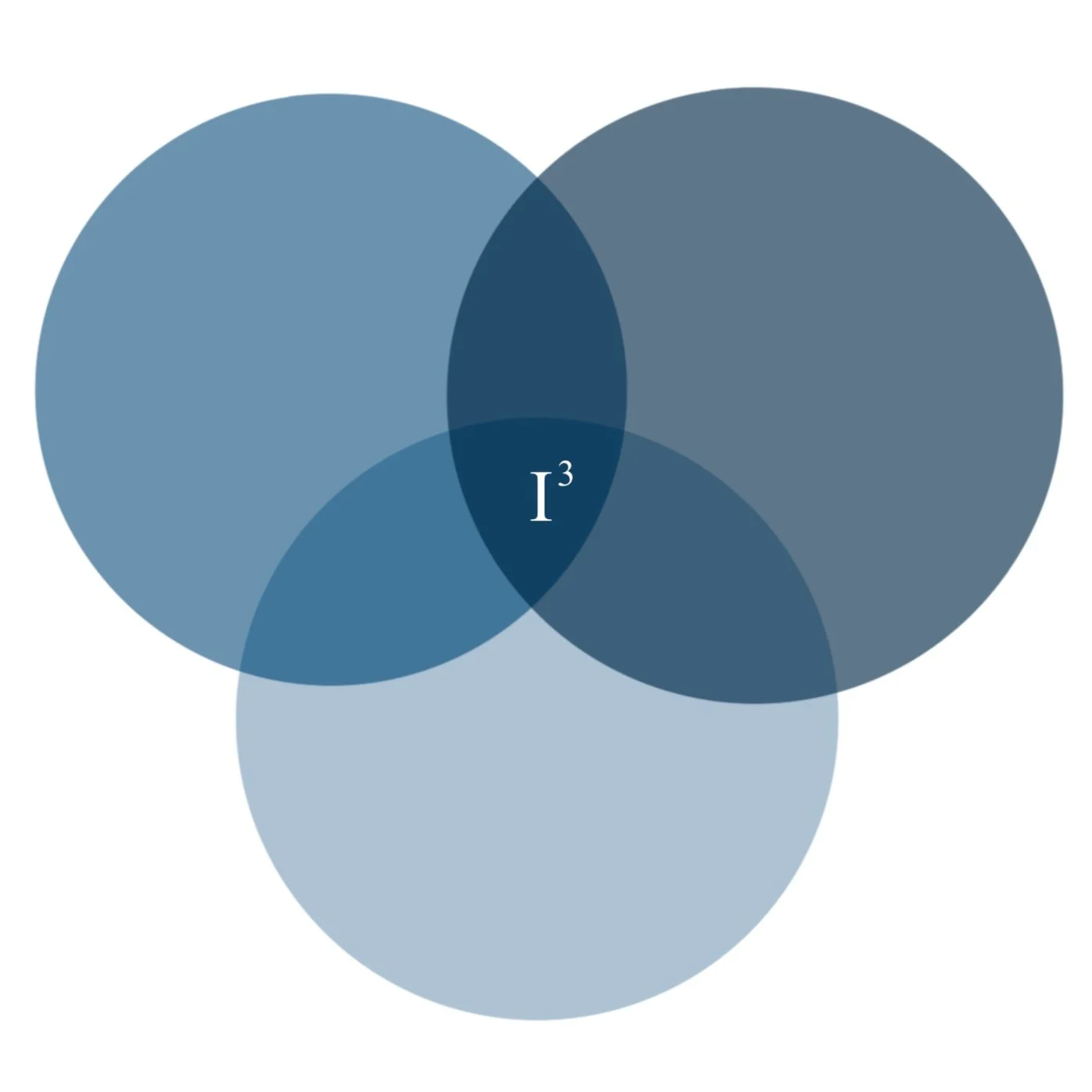

What is an I³ Enterprise?

Innovative

Inspired

Impactful

I³ enterprises represent those extraordinary and special God-inspired entrepreneurial ventures that design, develop and deploy technological innovations in a variety of industries, producing exponential societal, financial and Kingdom returns via scalable solutions to comprehensive problems which uniquely impact businesses, consumers, employees, families, and a wide-ranging set of global communities. I³ enterprises possess a faith driven mission and mandate to create profitable and sustainable businesses that address complex and far-reaching issues in an unconventional manner that not only yields superior economic and social benefits, but also unlocks entirely original methodologies and opportunities. I³ enterprises represent those extraordinary entrepreneurial ventures that design, develop and deploy inspired technological innovations in a variety of industries, producing exponential societal and financial returns via scalable solutions to comprehensive problems which uniquely impact businesses, consumers and wide-ranging global communities.

Unique Investment Perspective

Charles Hobbs, the founder and chief investment officer of 521 Capital, utilizes his more than 34 years of investment industry experience to construct a diversified long/short portfolio of global public equities that are fundamentally selected and tactically risk-managed, producing unique, durable and superior investment returns. Charles employs these same investment skills to unearth faith driven early-stage entrepreneurial enterprises deploying scalable technology and innovative solutions to address complex and consequential opportunities. Charles’ long tenure with a renowned Wall Street hedge fund specializing in short-selling global equities, serving initially as an analyst, then a global research director and eventually a co-portfolio manager, provides 521 Capital with a distinctive capability to recognize and properly assess future growth prospects, sustainability of financial returns and potential operational/strategic risks within both publicly traded companies and early-stage ventures. Charles’ finely honed fundamental risk assessment skill provides 521 Capital with a unique investment ability to more effectively discern those publicly traded companies and early-stage entrepreneurs who have truly discovered a “better and defensible mousetrap” for capitalizing on large-scale market opportunities.

Private Portfolio Investments